Understanding Basic Accounting Principles

For small business owners, a firm grasp of basic accounting principles is crucial for the effective management and sustainability of their operations. One foundational concept in accounting is the accounting equation, which states that assets must equal liabilities plus owner’s equity. This equation serves as the backbone of financial statements and guides business owners in understanding how their resources are financed and utilized.

Assets are resources owned by the business, which can include cash, inventory, buildings, and equipment. On the other hand, liabilities represent obligations owed to external parties, such as loans or accounts payable. Understanding the relationship between these two elements allows small business owners to evaluate their financial health and make informed decisions regarding investments and expenses. Moreover, it helps in identifying whether the business is growing responsibly or incurring excessive debt.

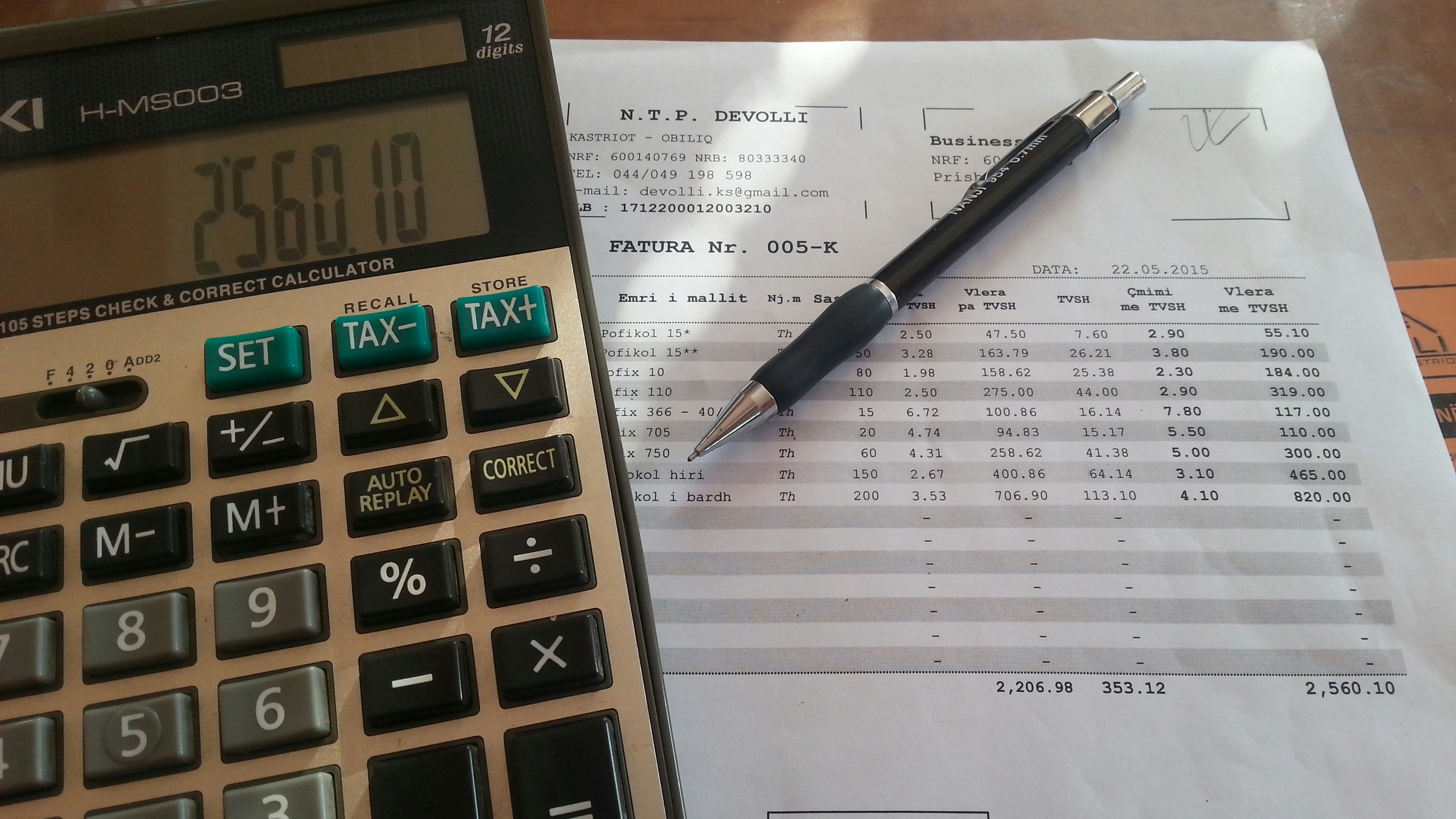

The importance of maintaining accurate financial records cannot be overstated. Proper documentation not only aligns with legal requirements but also provides a clear picture of the business’s performance over time. This includes tracking income, expenses, and all transactions related to assets and liabilities. By implementing robust record-keeping practices, small business owners can easily assess their financial situation, prepare for tax obligations, and make strategic decisions based on concrete data.

Additionally, having a basic understanding of accounting principles can empower business owners to effectively communicate with accountants and financial advisors. It creates a more collaborative environment where financial matters can be discussed with clarity and precision. All in all, knowledge of these fundamental concepts is essential for small business owners who aim to manage their finances effectively and ensure long-term success.

Utilizing Accounting Software

In today’s digital age, small business owners are increasingly turning to accounting software to enhance their financial management practices. The integration of accounting software simplifies a variety of tasks, such as invoicing, expense tracking, and financial reporting, which are critical for business operations. By automating these functions, business owners can save significant time and minimize the risk of errors that might occur through manual entry.

When selecting accounting software, it is important to consider popular options like QuickBooks, Xero, and FreshBooks. Each of these platforms offers a range of features tailored to meet the needs of small businesses. For instance, QuickBooks is well-known for its robust financial reporting capabilities and user-friendly interface. Xero, on the other hand, emphasizes real-time collaboration and has a strong emphasis on online invoicing. FreshBooks is particularly favored by service-based businesses for its simplified invoice management and time tracking functionalities.

Key features to look for in accounting software include the ability to generate detailed financial reports, manage invoices and receipts, track expenses in real-time, and offer integration capabilities with other financial tools. A cloud-based solution can also provide the added benefit of accessing financial information from anywhere, streamlining communication with accounting professionals and stakeholders.

Ultimately, utilizing accounting software not only enhances efficiency but also empowers small business owners to make informed financial decisions based on accurate data. By adopting these tools, business owners can focus their efforts on growth while ensuring their financial management processes are sound and reliable. This strategic approach can lead to more effective budgeting, forecasting, and overall business performance.

The Importance of Regular Bookkeeping

Regular bookkeeping is a fundamental practice for small business owners that ensures financial accuracy and aids in making informed decisions. By keeping meticulous records, businesses can gain a comprehensive overview of their financial health. It is advisable to update financial records on a weekly basis to capture all transactions in real time. This proactive approach minimizes the risk of errors and provides clarity when reviewing financial statements.

Organizing financial documents is equally essential. Implementing a consistent filing system, whether physical or digital, can streamline the bookkeeping process significantly. Small business owners should categorize receipts, invoices, bank statements, and other important documents by month and type. Utilizing accounting software can further enhance this organization, as it offers tools for easy categorization and retrieval of information when needed.

Regular reconciliations are another critical component of effective bookkeeping. Monthly reconciliation of bank statements with internal records ensures that any discrepancies are identified promptly. This practice not only helps in maintaining accurate financial records but also aids in detecting potential fraud or discrepancies early on. Additionally, regular reconciliations provide a snapshot of cash flow, enabling business owners to make better-informed financial decisions that can drive growth.

By incorporating regular bookkeeping practices, small business owners can avoid the last-minute scrambles often associated with tax season. Accurate and up-to-date records simplify the process of filing taxes and reduce the likelihood of errors, which could result in costly penalties. Ultimately, the habit of maintaining regular bookkeeping fosters a stronger financial foundation, allowing business owners to focus on their growth and success.

Managing Cash Flow Effectively

Effective cash flow management is crucial for the sustainability and success of any small business. Cash flow refers to the movement of money in and out of a business, and maintaining a positive cash flow ensures that a company can meet its operational needs while pursuing growth opportunities. One key technique for managing cash flow is forecasting. Business owners should prepare cash flow forecasts to predict inflows and outflows over a specific period. This involves estimating expected sales, accounts receivable, and anticipated expenses. By having a clear picture of future cash positions, small business owners can make informed decisions and manage their resources more effectively.

Tracking cash flows is equally vital. Small business owners should regularly monitor their cash inflows, which include revenues from sales and any other income, against their cash outflows, such as operating expenses, loan repayments, and investments. Utilizing accounting software can greatly simplify this process, allowing for real-time tracking of cash flow and generating reports that provide insights into financial health. Regularly analyzing cash flow statements can highlight trends and help identify potential cash shortages before they become critical issues.

Planning for expenses is another essential strategy. Small business owners should categorize and prioritize expenses to ensure that essential costs are always covered. It is advisable to maintain an emergency cash reserve to provide a buffer for unexpected expenses or seasonal fluctuations in revenue. Understanding the timing of when cash flows occur can allow business owners to align their spending with their income patterns, ensuring liquidity at all times.

By integrating these strategies—forecasting, tracking, and planning—small business owners can manage cash flow effectively, which is integral to their success and longevity in the competitive business landscape.

Understanding Tax Obligations

For small business owners, navigating the intricacies of tax obligations is crucial to maintaining compliance and ensuring the long-term success of the business. Understanding various types of taxes, including income tax, sales tax, and payroll taxes, is an essential first step in this process. Each tax category has specific requirements, rates, and deadlines that business owners must be cognizant of to avoid penalties and fines.

Income tax is typically levied on the profits earned by the business. Depending on the legal structure of the business—be it a sole proprietorship, partnership, or corporation—the tax responsibilities can vary significantly. Business owners must file their tax returns by the appointed deadlines while keeping detailed records of income and expenses throughout the tax year to substantiate any claims for deductions.

Sales tax, applicable in many jurisdictions, is another essential obligation that small business owners must understand. This tax is collected from customers at the point of sale and must be remitted to the appropriate state or local authorities. It is important for business owners to determine whether their products or services are subject to sales tax and to keep abreast of changing rates and regulations.

Furthermore, payroll taxes are directly associated with employee compensation and include Social Security, Medicare, and federal unemployment taxes. Business owners are responsible for withholding these taxes from employee wages and making the necessary contributions, thereby ensuring compliance with federal regulations.

To optimize tax obligations, small business owners should remain informed about potential deductions, which can alleviate some tax burdens. These deductions can include business-related expenses such as equipment purchases, travel, and certain operational costs. However, navigating tax regulations can be complex; thus, consulting a tax professional or accountant can provide essential guidance tailored to specific business needs, ensuring optimum compliance and strategic financial planning.

Creating a Realistic Budget

Establishing a realistic budget is a fundamental aspect of effective financial management for small business owners. A well-prepared budget serves as a financial roadmap, outlining expected revenues and expenditures, which in turn helps guide decision-making and strategic planning. The first step in creating a budget is to gather historical financial data, including past income statements and cash flow reports. This information provides insights into revenue patterns and expense trends, forming a solid foundation for your budget.

Next, it is crucial to project future income realistically. Small business owners should consider various factors, such as market trends, seasonal fluctuations, and any anticipated changes in the competitive landscape. Once income projections are established, categorize all expected expenses, differentiating between fixed costs (e.g., rent, salaries) and variable costs (e.g., raw materials, utilities). This categorization allows for a clearer understanding of financial obligations and aids in effective cash flow management.

After drafting the budget, monitoring actual performance against the budgeted figures becomes essential. Regularly reviewing financial metrics enables business owners to identify discrepancies and areas of concern promptly. Utilizing accounting software can streamline this process, allowing for real-time tracking and easy adjustments. If actual performance consistently deviates from the budgeted amounts, it may indicate the need for a strategic review, potentially necessitating an adjustment to either income projections or spending habits.

Ultimately, developing and maintaining a realistic budget is an ongoing process. As businesses evolve, so too should their financial plans. Small business owners are encouraged to revisit their budgets quarterly and make adjustments based on changing circumstances or business goals. Through diligent budgeting practices, small business owners can enhance financial stability, manage cash flow effectively, and support overall growth.

Knowing When to Seek Professional Help

As a small business owner, managing your own accounting can initially seem feasible. However, as your business grows, recognizing the right time to seek professional accounting help is crucial. Professional accountants are equipped with extensive knowledge and experience that can benefit your enterprise in numerous ways. There are several scenarios that serve as indicators that it might be time to engage an accounting professional.

One of the first signs that you may need professional assistance is encountering complex tax situations. Tax regulations can be intricate and frequently changing, making it challenging to keep up with the latest requirements. If your business faces unique deductions, multiple revenue streams, or if you operate in various states with differing regulations, engaging a tax professional can ensure compliance, minimize liabilities, and optimize your tax strategy.

Another situation where seeking expert accounting advice is beneficial involves the preparation of financial statements. Accurate financial reporting is essential for monitoring your business’s health and making informed operational decisions. If you find yourself struggling with generating balance sheets, income statements, or cash flow projections, an experienced accountant can provide accurate financial reporting, which is vital for stakeholders, investors, and lenders.

Additionally, if you notice gaps in your accounting knowledge or lack the time to devote to this aspect of your business, it may be prudent to consult with a professional. Effective accounting is not just about number crunching; it also involves strategic planning and analysis. By leveraging the expertise of an accountant, you can focus on core business operations while ensuring your finances are well-managed.

In essence, recognizing the indicators that it’s time to seek professional accounting help is a vital aspect of sound business practice. Seeking expertise at the right time can save you considerable time, resources, and potential financial setbacks.

Security and Data Protection in Accounting

In the realm of accounting, where sensitive financial information is routinely processed, the significance of data security cannot be overstated. Small business owners often face unique challenges when it comes to safeguarding their financial data, making it imperative to adopt robust security measures and best practices. Cyber threats have become increasingly sophisticated, targeting vulnerabilities in accounting systems to compromise sensitive information, which can lead to severe financial and reputational consequences.

One of the foremost strategies for protecting financial information is to prioritize data encryption. By encrypting sensitive data, businesses can ensure that even if unauthorized access occurs, the information would remain unreadable without the appropriate decryption keys. Additionally, implementing strong passwords and two-factor authentication for accounting software and financial accounts significantly enhances security by adding layers of protection against unauthorized access.

Another crucial aspect of data protection is regular software updates. Accounting software providers frequently release updates to address vulnerabilities and improve security. Small business owners should ensure that their software is always up-to-date, which helps mitigate risks from known threats. Furthermore, conducting regular security audits and assessments can identify potential weaknesses in data security protocols and help in implementing necessary improvements.

It is also essential to educate employees about the importance of data security. Employees should be made aware of phishing attacks and other common cyber threats, as they are often the first line of defense against potential breaches. Conducting training sessions on how to recognize suspicious activities can equip staff with the knowledge needed to protect sensitive financial data effectively.

Ultimately, a comprehensive approach to security and data protection in accounting is vital for small business owners. By implementing strong security practices, businesses can protect their financial information, reduce the risk of cyber threats, and ensure the integrity of their accounting processes.

Staying Educated on Accounting Best Practices

In the ever-evolving world of finance, small business owners must prioritize continuous education on accounting best practices. Staying informed about the latest trends and regulations is crucial for maintaining compliance and optimizing financial performance. Numerous resources are available to assist business owners in this endeavor, ensuring they remain knowledgeable about the complexities of accounting.

One effective way to enhance accounting knowledge is through online courses. Numerous platforms offer courses tailored specifically for small business owners, covering topics such as bookkeeping, tax regulations, and financial analysis. These courses often allow individuals to learn at their own pace, providing flexibility that suits busy lifestyles. Websites like Coursera, Udemy, and LinkedIn Learning offer a variety of options for different skill levels and areas of interest.

Attending seminars and workshops is another valuable strategy for staying updated on accounting best practices. Many professional organizations, such as the American Institute of CPAs (AICPA) and local business associations, regularly host events where experts share insights on current accounting trends and changes in legislation. These gatherings provide not only education but also networking opportunities, allowing business owners to connect with professionals who can offer guidance and support.

Moreover, following reputable accounting blogs, news outlets, and industry publications can aid in keeping up with the latest developments. Subscribing to newsletters from finance-related sources ensures that small business owners receive timely information about changes that could impact their operations. Engaging with online forums and communities dedicated to accounting can also provide peer support and insights that may not be readily available through formal channels.

By actively seeking education and information, small business owners can enhance their understanding of accounting best practices, ensuring they make informed decisions that positively impact their enterprises. Knowledge is empowering, especially in a field as complex as accounting, and continual learning is essential for long-term success.

Conclusion: Navigating the Accounting Landscape

In the complex realm of small business management, accounting emerges as a critical component that cannot be overlooked. The ten essential accounting tips discussed throughout this post illustrate the significance of maintaining precise financial records, understanding tax obligations, and utilizing accounting software. Small business owners can streamline their financial processes by implementing these strategies effectively, ultimately contributing to improved decision-making and overall business health.

Proper financial management ensures that a small business remains compliant with regulations while maximizing profitability. From the importance of separating personal and business finances to the benefits of regularly reviewing financial statements, a holistic approach to accounting plays a pivotal role in driving sustainable growth. By familiarizing themselves with these best practices, entrepreneurs can navigate the intricacies of their financial landscapes with greater confidence.

Moreover, recognizing when to enlist professional help is equally crucial in accounting. While the fundamental tips provide a solid foundation, there are instances where the expertise of an accounting professional can significantly enhance one’s financial strategy. Small business owners are encouraged to reach out to Rosado Accounting for tailored support. Our team is equipped to assist with bookkeeping, tax planning, and compliance issues, paving the way for successful business operations.

The path to effective accounting is unique for each enterprise; however, leveraging sound advice and practical tools will undoubtedly enhance prospects for success. As small business owners embark on this journey, they can benefit from a proactive approach to their financial affairs, ensuring that accounting becomes a strategic asset rather than a burdensome task.